Today, in 10 minutes or less, you’ll learn:

- 🔥 4 harsh realities not enough people talk about before going portfolio

- 💸 The hidden costs that can lead to getting stuck in the messy middle

SPONSORED

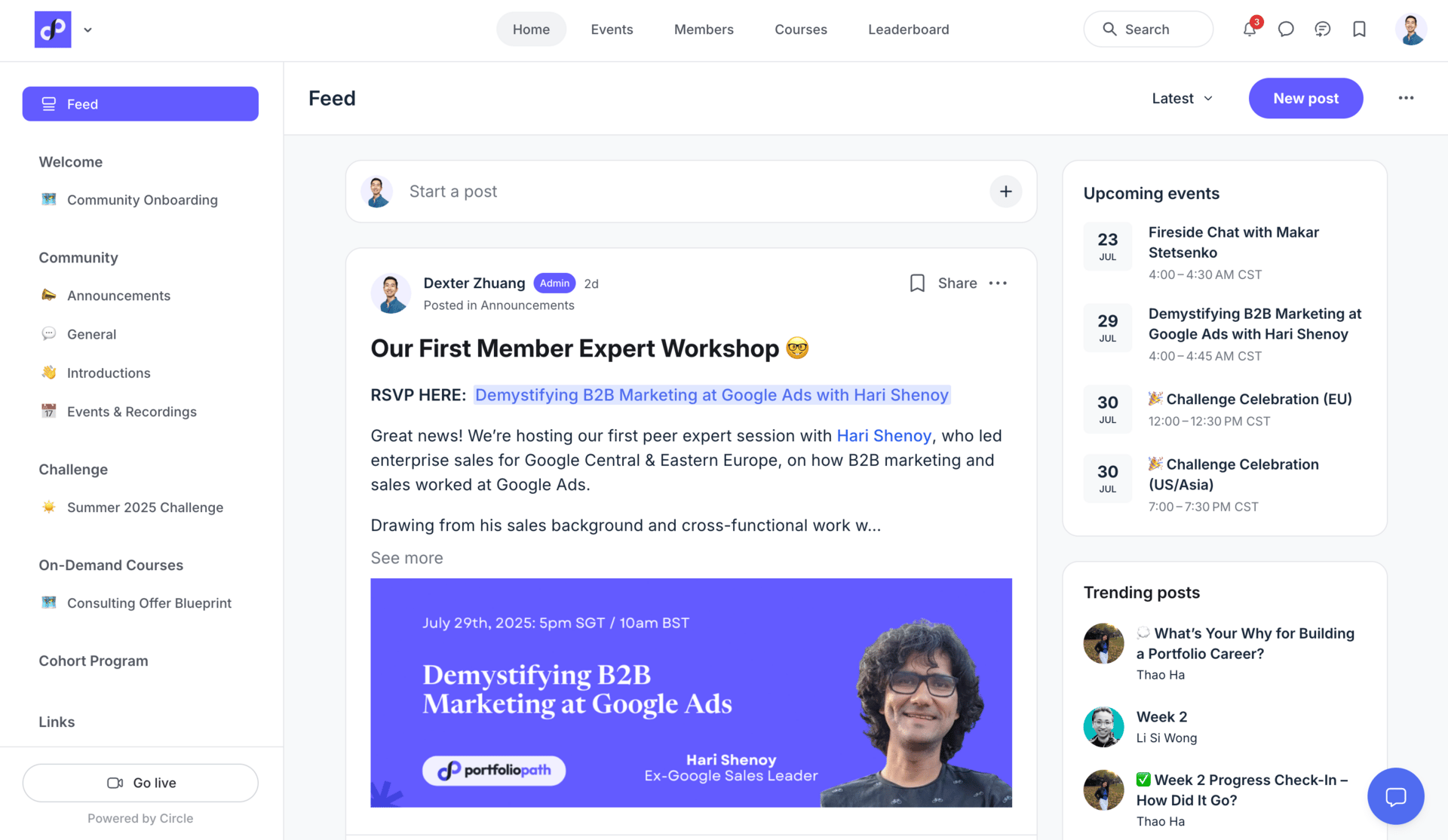

👉️ Join Our Invite-Only Community

Tired of navigating your portfolio career alone?

If you have 5+ years of working experience, join the waitlist for our invite-only community (launching August/September 2025).

🚀 Why join the community: Accelerate your learning, grow your revenue, and build genuine relationships with like-minded peers on the portfolio path

🎯 What you get:

✅ Lifetime access to Portfolio Path Community

✅ Expert fireside chats, peer workshops, & community calls

✅ 30-day challenges and group accountability

✅ Shared resource library (AI workflows, offer templates, etc.)

✅ Full access to PT Consulting Launchpad lessons + workbook

✅ Full access to Consulting Offer Blueprint

Limited founding spots available. Join the waitlist, and we'll contact you about the next intake soon!

To get your brand in front of 7k+ professionals, founders, and consultants, fill this out and let's chat.

🎢 4 ugly truths of the portfolio path

A quick Google search for “tech careers” returns 2,180,000 results.

FAANG career ladders, compensation schemes, “how to become X” guides, bootcamps, and countless case studies.

But unlike well-trodden tech career paths, there’s not a cookie-cutter script for building a meaningful portfolio career.

Instead, it depends entirely on you.

Your values, strengths, faults, personality, and experiences.

What’s standing in between you and Person-Path Fit is a mix of self-discovery, experimentation, financial constraints—and candidly, the cojones to act.

On the other hand, I have definitely noticed several common pitfalls that people struggle with along the way. That’s as close to a “standard script” as we can get.

In this piece, I’ll highlight 4 ugly truths about portfolio careers that not enough people talk about and what you can do about them.

Truth #1: Your income will feel volatile like entrepreneurship 📊

Let me start with the one that hits many people hard:

Mixing finance and independent work is certainly not for the faint of heart.

Going from consistent bi-weekly paychecks to feast/famine cycles is an emotional rollercoaster.

If you’ve only worked full-time roles, then portfolio careers will seem like your “escape the 9-to-5” Get Out of Jail Free card.

But I assure you - you’ll soon realize you’ve been sorely mistaken.

Like any other entrepreneur - startup founder, solopreneur, or consultant - with a portfolio career, you’re forced to eat only what you kill. That means hunting to survive, or else risk starving out on the field.

So what’s an aspiring portfolio pather to do?

How to deal with it:

- Follow the 1-2 Rule. If you haven’t left your FT job, shoot for 1x year of expenses saved and 2x monthly expenses from your business income.

- Consider securing your future retirement first (Coast FIRE). Being on track for my financial goals gave me more confidence to experiment.

- Take turns with your partner. It’s rarely discussed in public, but when I talk to couples privately, if one is pursuing a portfolio career (or entrepreneurship), the other is a spouse with FT work and benefits (see next truth).

Truth #2: Healthcare becomes a big monthly expense 🏥

Self-employed health care is rough, especially in several mature markets like ‘merica.

If you go down the Reddit rabbit hole, you’ll see comments like one from an American self-employed couple spending ~$11k/year with a $7K deductible plan and a family of 4 is spending over $20k/year on their basic plan. 🤯

In short, self-employed health care plans cost 2-3x what you pay as an employee.

High-deductible plans means you’re pretty much uninsured for anything under a few thousands dollars.

How to deal with it:

- Check out self-employment benefits platforms like Besolo.io. By aggregating under a national PPO, they can access better rates or networks.

- Shop for healthcare on the open marketplace

- Use international health care plans if living abroad. I used SafetyWing Complete (affiliate) for my health appointments while living outside of the US, and it’s worked smoothly while being reasonably priced ($208/mo).

Truth #3: Self-employment taxes are more complex 💰️

The first time I realized I had to make quarterly tax payments was a rude awakening.

If you’re American, (or resident of an entrepreneur-unfriendly tax jurisdiction), get ready to go down the rabbit hole of tax minimization.

I know I know, everyone’s favorite pastime!

For example, American solopreneurs get hit with the full self-employment tax (15.3% on top of income tax).

You can deduct expenses to reduce your taxable income substantially, but you’ll still pay higher Social Security/Medicare taxes than employees.

You also have to pay your estimated taxes quarterly. If you don’t, you risk penalties and interest.

There are definitely ways to minimize your tax burden through careful planning (S-Corps, Solo401k’s, expat tax exclusions) but that means spending time learning or money hiring an accountant to help you.

Ready to start talking about taxes at dinner parties?

How to deal with it:

- Set aside 15-20% of your income for taxes immediately. I setup an auto-transfer for 15% of my business income to a tax sub-account using Mercury Business (affiliate).

- Take advantage of your business deductions. Expenses like home office, software, internet, phone, travel, and even health insurance premiums.

- Get an accountant early. Did you find what I wrote confusing? Time to seek a professional to help you with 2026 tax planning.

Truth #4: Your professional identity gets scrambled 🔮

"So what do you do exactly?"

This question used to make me break into a cold sweat.

And I’m not the only one —

Tim Huang, former PM in SF and Portfolio Path reader; Youtuber Ali Abdaal; and Andy Johns, former tech exec in Silicon Valley, all recently wrote about the challenges of leaving behind a “successful career” and reconstructing their personal sense of value and self-worth.

Here’s the harsh truth people rarely tell you:

If you’ve been high-achieving for the majority of your life, it is going to take some serious deprogramming and inner work to go from living a “successful” life to an interesting life - without hitting the abort button.

But let’s say that you’re giving it your best shot. And now you’re in the messy middle - the valley after leaving behind the last mountain peak of your career.

How do you navigate through the valley to reach the second peak?

How to deal with it:

- Discover and double down on your zone of genius. No matter your title or business, you can always count on the intersection of your strengths and what brings joy.

- Run tiny experiments. Test new aspects of your identity for 1-2 weeks instead of making permanent declarations. "I'm trying writing for 30 days" beats "I'm a writer now."

- Get creative with work arrangements. Mix consulting, FT roles, advising, and teaching. Don't limit yourself to one box just because it's easier to explain.

- Find like-minded peers. It can get lonely in the valley. Shameless plug - we designed our invite-only community exactly for this reason: to help you connect and grow with other portfolio careerists. Come join us.

The bottom line

Portfolio careers aren't the “escape the 9-to-5” dream that you see on Instagram.

They're a set of trade-offs. More autonomy and flexibility, yes. But also more uncertainty and accountability.

That’s why I strongly believe the people who thrive on this path aren’t running away from something. They’re running towards a compelling vision of work that aligns with their values.

If you're considering the portfolio path, factor in these realities:

- Build a bigger financial runway than you think you need

- Prepare for potential admin complexity (taxes, healthcare)

- Invest in systems and community to combat isolation

- Accept that you’ll likely deal with identity conflicts

However, for those who are prepared for these ugly truths?

The ability to design work around your life instead of the other way around make the challenges worth it.

I wouldn’t have it any other way.

Thanks for reading. If you’d like to grow alongside other portfolio careerists, join the waitlist for our invite-only community.

💎 Last Week’s Gems

🧩 What Gen Z’s Portfolio Careers Mean for the Workforce (Upwork)

😫 Why Are Managers So Miserable at Work? (WSJ)

📊 The Substack AI Report (Arielle Swedback)

😰 Encore Anxiety (Anu Atluru)

🤩 Community Wins

Our members have been crushing it in their 30-day lead gen challenge! Here's what's been happening behind the scenes:

🔗 Brandon → Built solid lead pipeline from networking in local startup events

🌏 Michael → Balanced cold outreach with getting a paid startup mentorship (Southeast Asia market entry)

📚 Li → Published 3-part resilience series + sent first proposals to potential clients

💡 Adi → Generated 95 content ideas + launched new consulting website

👶 Chloe → 70% book completion + newsletter launch (while new parenting!)

🎭 Hari → Led B2B Marketing Workshop for our community + pursued creative projects like busking on the streets of Dublin!

Want to join exclusive members events? Join the waitlist for our invite-only community. We’ll notify you for our next intake.